In today’s fast-paced business environment, where efficiency and cash flow are paramount, FinFloh emerges as a beacon of innovation for CFOs and finance teams. This cutting-edge accounts receivable software, powered by AI-driven customer workflows, is transforming the landscape of invoice management, collection follow-ups, cash application, and forecasting. Let's delve into how FinFloh is setting a new standard in financial management. 🌟

At its core, FinFloh offers an end-to-end solution designed to streamline and automate the intricate processes of accounts receivable management. By seamlessly integrating with your existing ERP and CRM systems, it not only simplifies collection follow-ups but also expedites dispute resolution, ensuring a smoother cash flow. The genius of FinFloh lies in its ability to tailor automated workflows for buyers across different risk categories, thereby enhancing credit decision-making with buyer data and market intelligence. Moreover, the software completes the Invoice-to-Cash flow by automating cash application and providing accurate forecasting, a feature that sets it apart in the realm of financial software. 🚀

The impacts of adopting FinFloh are multifaceted. From significantly reducing Days Sales Outstanding (DSO) to boosting collection efficiency by eliminating manual tasks and errors, FinFloh promises a substantial increase in operational efficiency. The AI Impact, as highlighted by the team, aids in making informed decisions for collections, cash application, and credit onboarding, while its predictive capabilities offer unmatched accuracy in forecasting and buyer intelligence. Furthermore, with minimal-code integrations, FinFloh boasts compatibility with all major ERPs, CRMs, and accounting software, ensuring that businesses can quickly adapt and benefit from its offerings. 📊

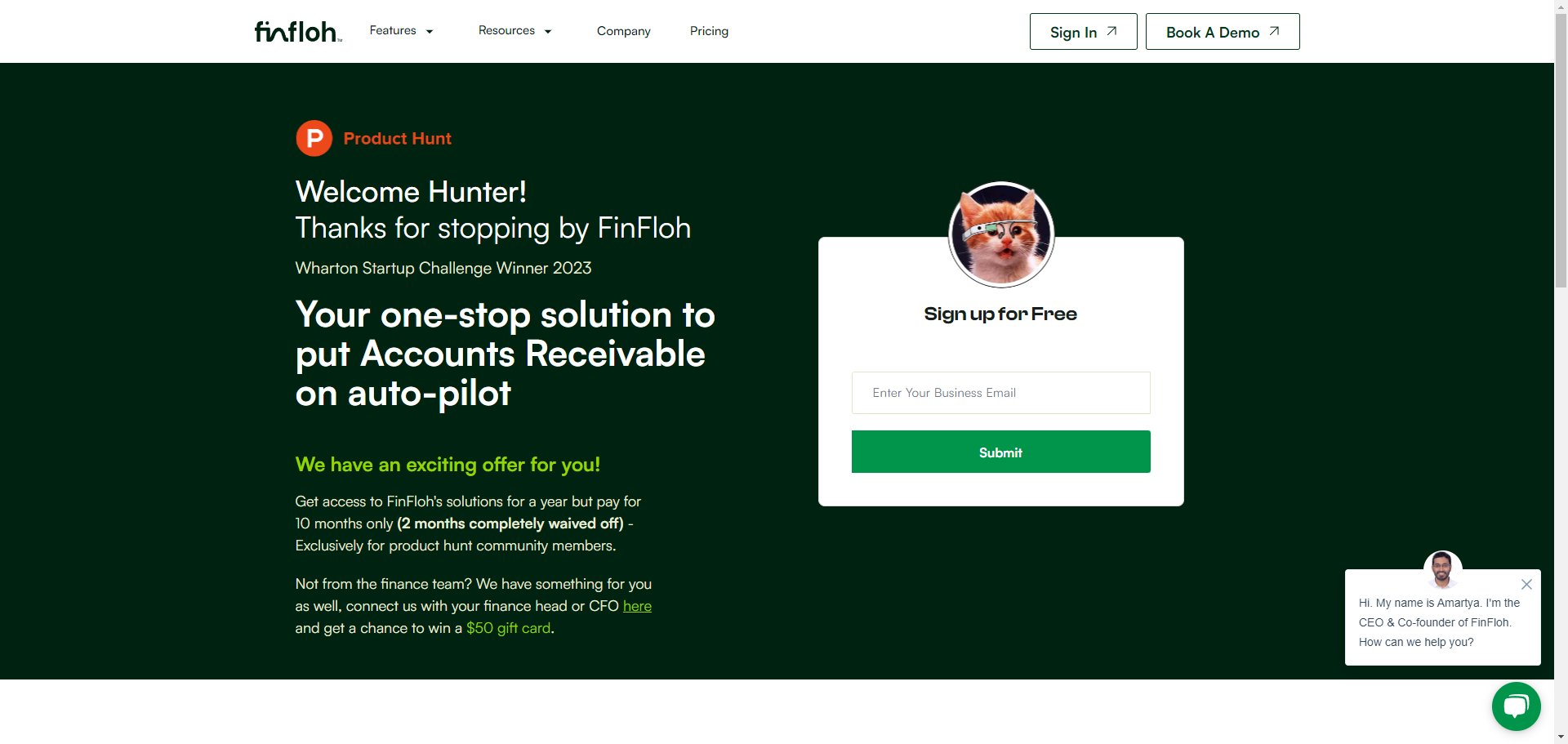

Behind FinFloh is a team of visionaries, led by CEO and Co-founder Amartya, whose expertise in fintech and successful track record in building and selling products shines through this innovative solution. Recognized as the Wharton Startup Challenge Winner 2023, FinFloh is not just a product but a movement towards automating financial operations, making manual receivables a thing of the past. With exciting offers for the Product Hunt community, including waived fees and exclusive trials, FinFloh is poised to revolutionize how businesses manage their finances. 💡

In summary, FinFloh stands out as an AI-driven solution that automates and optimizes accounts receivable processes, ensuring businesses remain cash flow positive while freeing up valuable time and resources.